Qualification

Participation

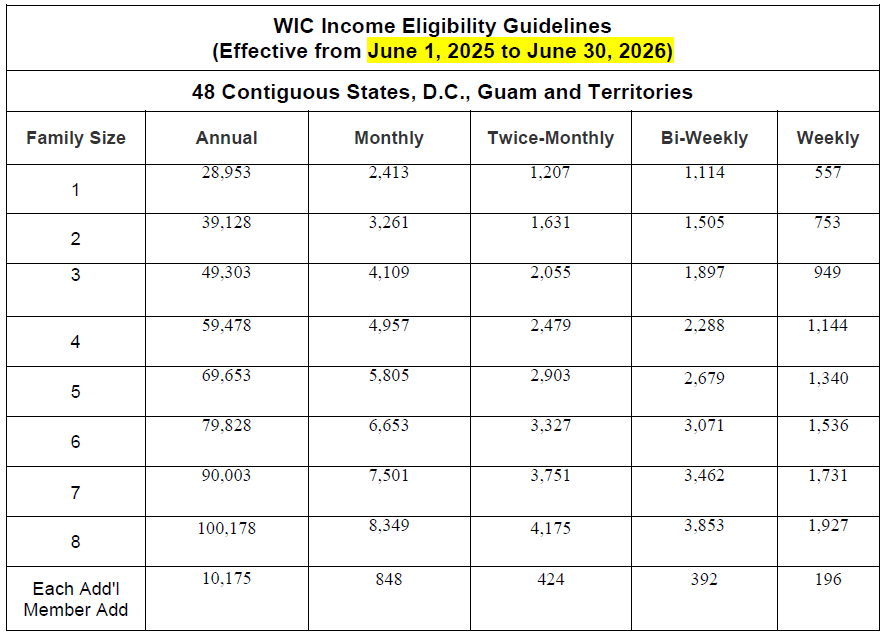

Participation in the WIC Program is limited to those persons whose gross income (i.e., income before deductions for income taxes, Social Security taxes, insurance premiums, bonds, etc.) is equal to or less than the income poverty guidelines increased by 185%. No allowance is made for the use of a standard deduction or hardship when calculating a family's income.

WIC Program Income Eligibility Guidelines